Underwriting Solutions

Property Guardian’s wildfire solutions provide unmatched property-level insights and customized mitigation strategies, empowering insurance carriers, agents, and brokers to achieve superior underwriting results and protect their business.

Our solutions not only help you enhance risk selection and minimize potential losses with precise property and parcel insights, but also open the door to premium opportunities in areas that might have previously been declined. Backed by top data and modeling partners, we also offer in-depth mitigation guidance and powerful wildfire propagation insights to keep you ahead of high-risk zones during peak wildfire season.

Our Products

Snapshot Risk Insights Report

Our Snapshot Risk Insight Report is tailored for underwriters and includes a proprietary score to simplify the overall assessment of a property’s wildfire risk and resiliency. Improve risk selection and speed underwriting decision-making with a streamlined view of a property’s structure, parcel, community and regional risks.

Core Risk Insights Report

Our Core Risk Insight Report offers everything in our Snapshot Report, but dives deeper to drive stronger underwriting outcomes. We provide a comprehensive view of a property’s risk and best-in-class wildfire mitigation guidance powered by our partnership with Technosylva.

Executive Risk Insights Report

Our Executive Risk Insight Report delivers a complete picture of a property’s risk, paired with top-tier insights on wildfire exposure. Our Certified Wildfire Mitigation Specialists (CWMS) personally review each property, providing an opinion of risk and tailored mitigation and engineering guidance for the property.

Moratorium Insights

Get the critical insights you need to anticipate and manage risk, make smarter underwriting decisions and protect profitability. Subscribe to our complimentary Daily Active Wildfire Moratorium Insights Report or seamlessly integrate this data into your systems with our Moratorium Insights API.

Featured Collateral

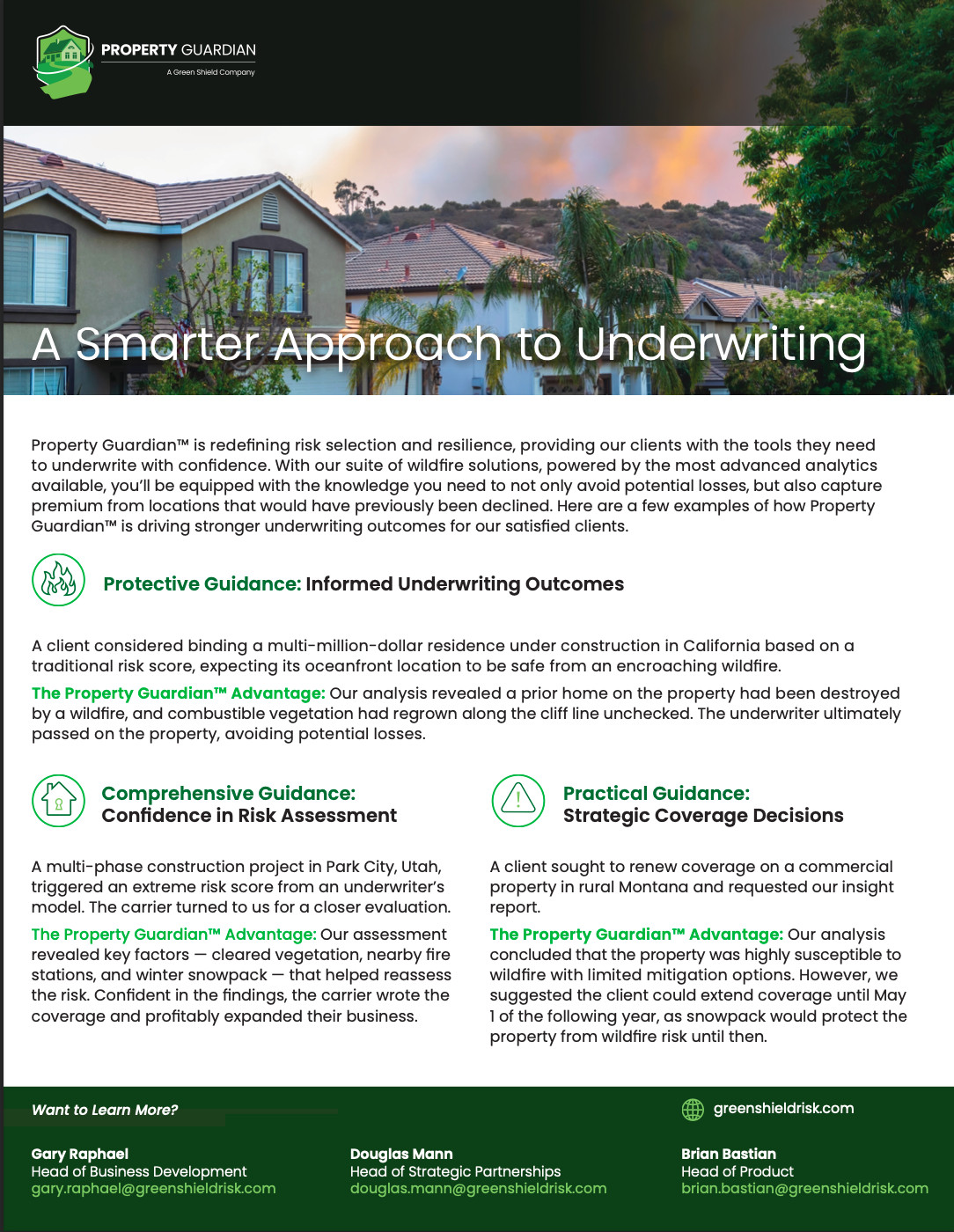

A Smarter Approach to Underwriting

Property Guardian is transforming the way risk selection and resilience are approached, equipping our clients with the confidence they need to make smarter underwriting decisions. Discover how our solutions are empowering clients to achieve better outcomes through sharper risk selection, accurate assessments, and strategic coverage choices.

What People Are Saying

“This is creating significant lift in our underwriting process. We have received nothing but positive feedback.”

– Director of Risk Management, Prominent Global Insurer

“Your willingness to help property owners proactively reduce their exposure is game-changing.”

– President, National Carrier

“Thank you so much for the awesome demonstration of your assessment! This information has the potential to make us look heroic to our clients.”

– Senior Advisor, Global Insurance Broker

“Wow! That’s incredibly insightful. We’ve never seen those features in a property report before.”

– Head of Insurance, Multi-Family Office

“California is a challenging marketplace for us due to risk concentration, and your tools will be essential in helping us manage that exposure.”

– Senior Executive, Specialty Commercial MGA

“This is hands down the best wildfire presentation we have ever seen, and I have seen a lot.”

– Chief Underwriting Officer, London Reinsurer