Solutions for Commercial Property Owners

Property Guardian is designed to meet the unique needs of large, multi-structure commercial properties in wildfire-prone areas. From ski resorts and wineries to hospitals and casinos, our team of Certified Wildfire Mitigation Specialists, backed by National Fire Protection Association standards, help identify vulnerabilities and implement tailored solutions.

Our actionable insights and expertise ensure your property is not only more resilient, but also more attractive to insurers — helping you secure better coverage and greater peace of mind.

Enhance the Insurability of Your Property

At Property Guardian, we provide commercial property owners with advanced wildfire risk insights and customized strategies to protect what matters most. Our Wildfire Risk Insight Reports deliver a clear roadmap to help you take control of your property’s wildfire risk. From single commercial properties to a large, multi-structure portfolio, our reports empower you to strengthen resilience, safeguard your investment, and secure better insurance coverage options.

With our Wildfire Risk Insight Reports, you can:

- Improve Insurability: Work collaboratively with your broker or agent to secure comprehensive coverage for your commercial property — at competitive rates.

- Safeguard Your Investment: Gain confidence knowing you’ve implemented specific, actionable mitigation measures to protect your property and business assets from wildfire risks.

- Increase Property Value and Appeal: Make your commercial property more attractive to tenants, investors, or buyers by enhancing its safety, resilience, and insurability.

- Support Community Resilience: By proactively mitigating wildfire risks, you’re not only protecting your property but also contributing to the safety and sustainability of the surrounding community.

Ready to Boost Your Insurability?

Protect your investment and unlock better insurance options with our wildfire risk insight reports. Reach out today to see how we can help safeguard your commercial property and improve your insurability!

Become More Resilient & Insurable

Don’t leave your commercial property’s future to chance. Our Wildfire Risk Insight Reports provide a detailed, customized assessment of your property’s wildfire risk factors — along with actionable strategies to reduce those risks. Make your property safer, more insurable, and more appealing to tenants, investors, or buyers. Order your report today and take the first step toward protecting your investment and ensuring peace of mind.

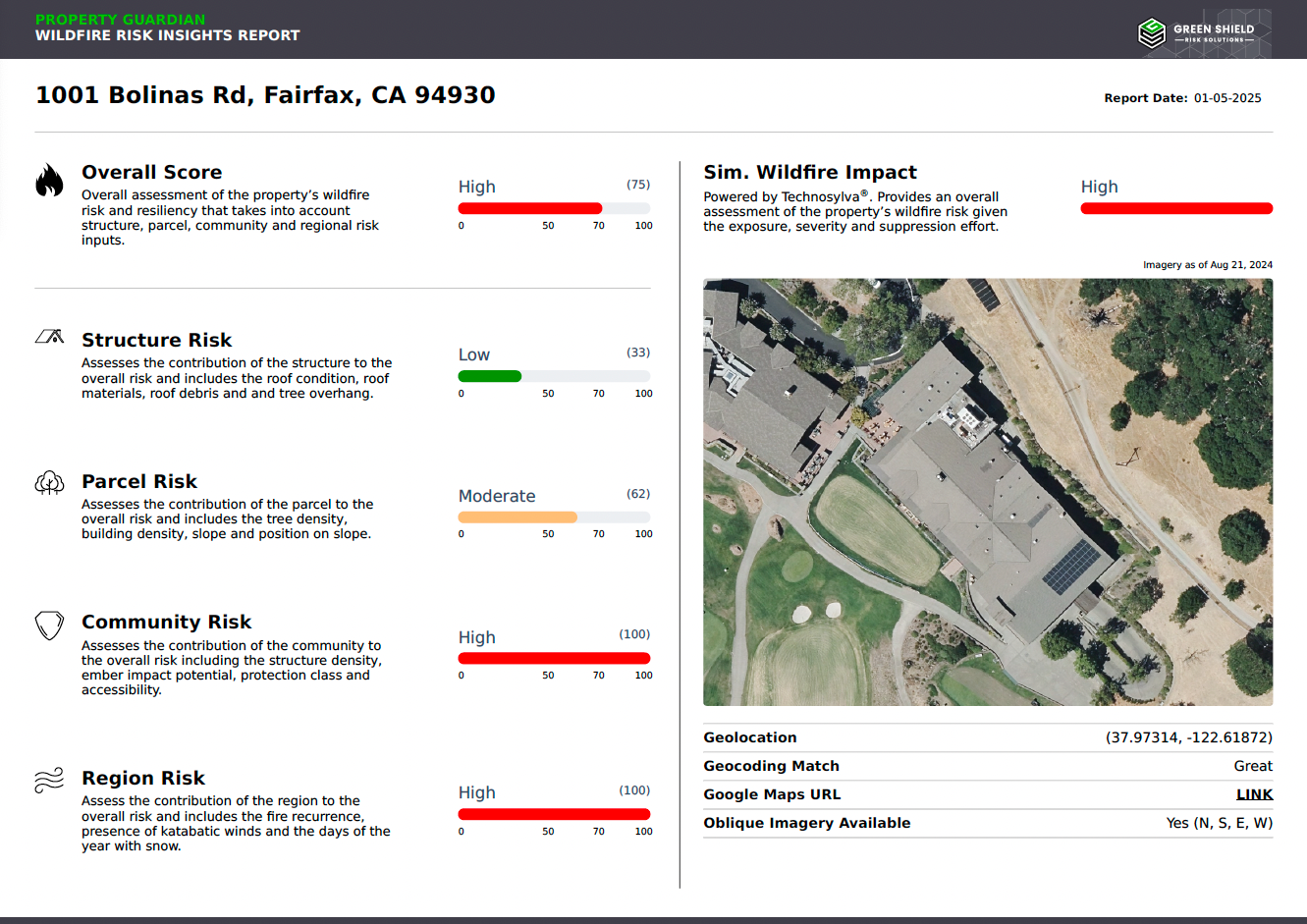

Snapshot Risk Insight Report

- Multi-level scoring for structure, parcel, community and regional exposure

- Overall wildfire resiliency score

- Defensible space conditions

- Latest aerial imagery

- Historical wildfire map

- Automated mitigation recommendations

- On-demand ordering delivered to your inbox in seconds

Core Risk Insight Report

Everything in Snapshot, plus …

- Detailed breakdown of primary risk factors contributing to scores

- Additional high-res aerial imagery

- Critical fire protection and recurrence details

- Simulated wildfire impact modeling

- Expert opinion of risk available

- On-demand ordering delivered to your inbox in less than 10 minutes

Executive Risk Insight Report

Everything in Core, plus …

- Bespoke risk mitigation recommendations via rec letter

- Detailed opinion from our from our Certified Wildfire Mitigation Specialists (CWMS)

- Access to our experts on complex risks

- Delivered via email and our end-to-end Risk Mitigation Platform in less than 72 hours

How Can Wildfire Risk Insight Reports Improve My Insurability?

Defensible Space

Our reports highlight defensible space conditions. Clearing vegetation and maintaining fire-safe zones can reduce wildfire risk and make the commercial property more insurable.

Structure Risk Score

Our reports identify vulnerabilities in the building materials. Upgrading to fire-resistant materials (e.g., metal roofing, ember- resistant vents) can improve insurability.

Parcel-Level Risks

Our reports show specific hazards like dense vegetation or risky topography. Addressing these through fuel reduction or landscaping can lower risk.

Fire History

We provide data on past wildfires within five miles of the property. Proactively protecting against recurring risks (e.g., installing sprinkler systems) can positively impact insurance rates.

Community & Regional Risks

These scores reflect the surrounding area’s risk. Participating in community-wide mitigation efforts may enhance insurability.

Fire Protection Services

We provide information on nearby fire stations and water sources. Installing private fire protection (e.g., water tanks) can improve insurability if public services are limited.

Wildfire Spread Modeling

Our modeling predicts how fire could reach your commercial property and includes important details such as direction, rate-of-spread, flame lengths and most likely path of ignition. Strengthening areas most vulnerable helps reduce risk and improve insurability.

Mitigation Modifiers

We identify catastrophe model attributes insurers should be referencing when modeling the wildfire losses for producing a pure premium. These mitigation modifiers may improve coverage availability and pricing.